Examine This Report on Refinance Melbourne

Melbourne Broker Things To Know Before You Get This

Did they have a great experience? You may also wish to ask the broker for the contact details of a few of their very own clients. Since acquiring a home is among the most significant financial investments that you'll ever make, research lending products on your own as well as always ask difficult questions of your broker including what their compensation price is.

You must never really feel like you're being pressured to authorize on to a mortgage. As your monetary as well as personal scenario modifications over time, whether it's due to having kids, needing to renovate or nearing retired life, you'll need a mortgage that evolves with you.

From application, pre-approval, approval-in-principle (AIP or condition authorization) and also negotiation, they must exist with you every action of the way as well as past. If you wish to speak to among our elderly mortgage brokers for a cost-free, no obligation, just call us on or finish our on-line query kind today.

Indicators on Mortgage Brokers Melbourne You Should Know

The duty of a Home loan Broker can be complicated, specifically if you are a first home buyer. refinance broker melbourne. Seasoned home mortgage brokers play a critical duty in working as the liaison for you as well as offered lenders. https://www.newsciti.com/author/unicornserve/. It pays to be familiar with the various benefits and drawbacks of collaborating with mortgage brokers.

Home loan brokers usually do not charge you a charge for their service, yet instead earn compensations on finance they aid in setting up from the financial institution. They primarily make money the very same per bank, so you do not have to bother with your broker offering you biased house car loan items. Home mortgage brokers will certainly suggest house finance items that are lined up with your special circumstance.

A great deal of home loan brokers are new startups that have actually not been around that lengthy. They do not have the experience as well as volume that much more established companies have. You'll need to find a brokerage firm with a long background of delivering worth for customers, where experience as well as loan provider partnerships are concerned. Not all home mortgage brokers are backed by a certified support team.

Facts About Mortgage Broker In Melbourne Revealed

Coast Financial sticks out among all other mortgage brokers as the # 1 relied on partner that realty representatives are probably to advise in Australia. It has been granted the finest, visit here large independent home loan broker, which suggests you can trust that you're collaborating with a broker that has the range, stamina, and also experience to combat for the ideal deal for you.

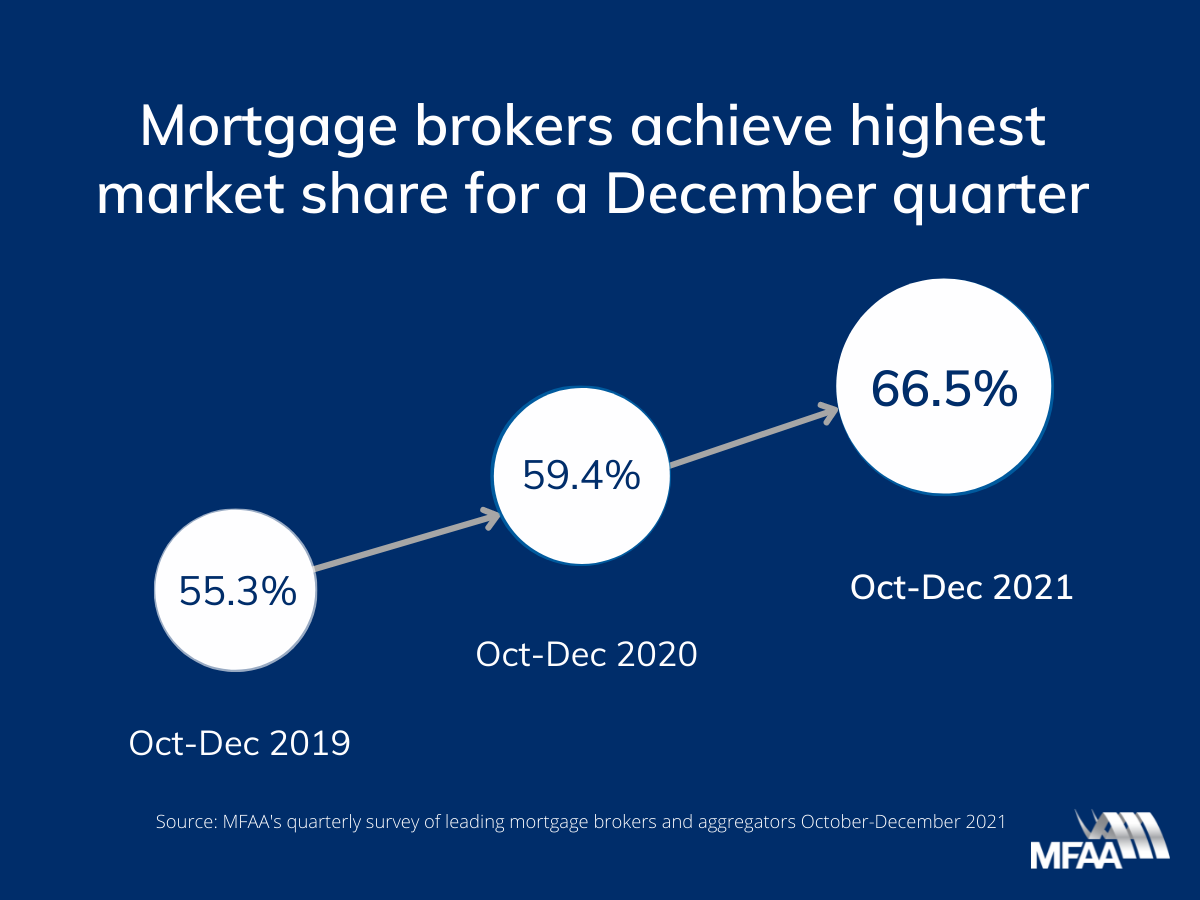

If you are in the marketplace for a home mortgage, you might be thinking about making use of a home loan broker. In Australia, home loan brokers compose even more than 50% of all home mortgage. Why are more Australians picking to utilize a home mortgage broker? In the article below we discover the pros and disadvantages of using a home loan broker for your following home mortgage.

They will bargain with banks, cooperative credit union as well as other credit rating carriers in your place, and also might have the ability to set up unique bundles or offers. A home loan broker can likewise assist you handle the procedure from application to settlement, supplying suggestions in the process. A home mortgage broker will certainly do the leg benefit you (melbourne broker).

Unknown Facts About Mortgage Broker Melbourne

The services of a mortgage broker are usually at no charge to you, as the lender pays a commission to the broker once the financing has actually resolved. This indicates that you have access to a solution to obtain the most effective car loan for you without costing any kind of extra - melbourne broker. Simply like a physician or mechanic, home mortgage brokers are professionals in their area.

If a credit report provider does not pay compensations, the broker might not include their fundings on the list of items they suggest. Mortgage brokers are compelled by regulation to reveal the details of their compensations with the intro of a disclosure document under the Home loan as well as Money Organization of Australia's National Consumer Credit Security Act.

Call us on today for a personal chat on exactly how we can aid you.

Things about Mortgage Brokers Melbourne

This is a minimum demand to function as a broker in Australia as well as will likewise assist to qualify you for further research study. There are lots of instructional institutes that offer this course so make certain you do your research and pick a recognised, approved supplier. This is not a requirement for licensing, it is highly recommended that you proceed your research studies after completing the Certification IV.

Your coach will not just lead you with the first two years of your job yet they will usually additionally function as an aggregator, providing you access to a variety of loan providers. There are a few choices in Australia, including the Mortgage and Financing Association of Australia (MFAA) and also the Finance Brokers Organization of Australia (FBAA).

Comments on “The 5-Minute Rule for Mortgage Brokers Melbourne”